The Microchip Shortage is Good for Dealers

Experts now predict that microchip supply issues will likely continue into 2024, which is no surprise here. When the microchip industry forecasted that microchip availability would be normalized by the end of 2022, we laughed. Impossible. When they said mid-2023, we thought “maybe,” but the new projections of seeing issues well into 2024 sounds more realistic.

This shortage continues to affect many industries, but most notably the automotive industry. These new predictions mean we will likely be seeing the ripple-effect of Covid throughout the rest of this decade as the microchip shortage will possibly extend through 2026 (and maybe beyond).

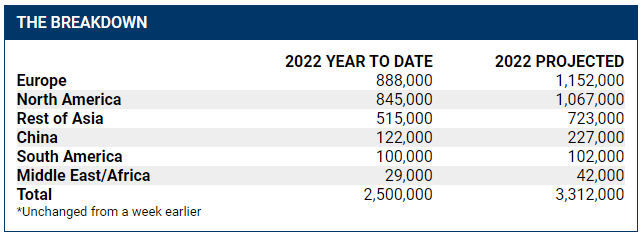

Production is suffering. An additional 36,000 vehicles were cut from production in June by North American automotive plants, and it’s estimated that automakers worldwide will reduce output by a total of 3.3 million vehicles by the end of 2022.

Source: AFS

Many companies have vehicles built, but are waiting for microchip shipments to complete production before they can be shipped to dealerships. GM, for example, produced 95,000 vehicles in Q2 that are sitting around, impatiently awaiting to have microchips installed.

What does this mean for sales? Well, as expected, they continue to drop - 21 percent in Q2 and 18 percent in the first half overall. While numbers were up slightly in June compared to May, they were significantly lower than June 2021.

Consumer demand is still high, but the vehicles just aren’t available. Ford stated that about half of its sales in June were for previously ordered vehicles, which isn’t surprising considering the brand also reported only having a 51-day supply of vehicles.

GM’s sales volume decreased by 15 percent, but it was still enough for them to reclaim its #1 spot from Toyota. Deliveries were down across the board for the automaker - Chevrolet 11 percent, GMC 14 percent, Buick 56 percent, and Cadillac 6.7 percent.

Toyota, Stellantis, Honda, Hyundai, Kia, Subaru, VW - they all saw significant drops, so the problem truly is plaguing the industry as a whole. Even luxury brands like BMW, Audi, and Bentley are seeing reductions.

Tesla -- the brand that has been mostly unaffected by the crises over the past few years -- also saw a drop in Q2, a result of production halts in Shanghai caused by Covid restrictions.

Dealers are still making out like raiders. Dealers 2022 YTD profits are higher than 2021. It’s the basic principle of supply-and-demand. Vehicle supply is limited, with many empty or near empty lots. But people want vehicles, and they’re done waiting for them. By now consumers have recognized that production and availability aren’t going to be changing any time soon. Consumers are still willing to pay the increased prices and wait weeks (or months) for delivery.

It’s estimated that it will be upwards of 3 years before we see a normalized balance of supply and demand for vehicles. It’s still an excellent time to be an auto dealer, which makes it a good time to sell your dealership.

Blue Sky values have soared over the past 2 years. As we know, Blue Sky is calculated by reviewing normalized net profits over the past 3 years. Previously, a 20-30 percent discount was applied to these super-sized profits caused by vehicle shortages, for what the industry saw as an anomaly in profits through Covid and last year’s chip shortage.

Now that we know the chip shortage is a pseudo-long-term problem affecting the industry, these discounts are disappearing, so Blue Sky values are averaging a 117-percent increase or more depending on the brand since the end of 2019, now achieving even more lofty levels. If you’re looking to off-load stores or retire, now is the time to do it if you want to max the Blue Sky value.